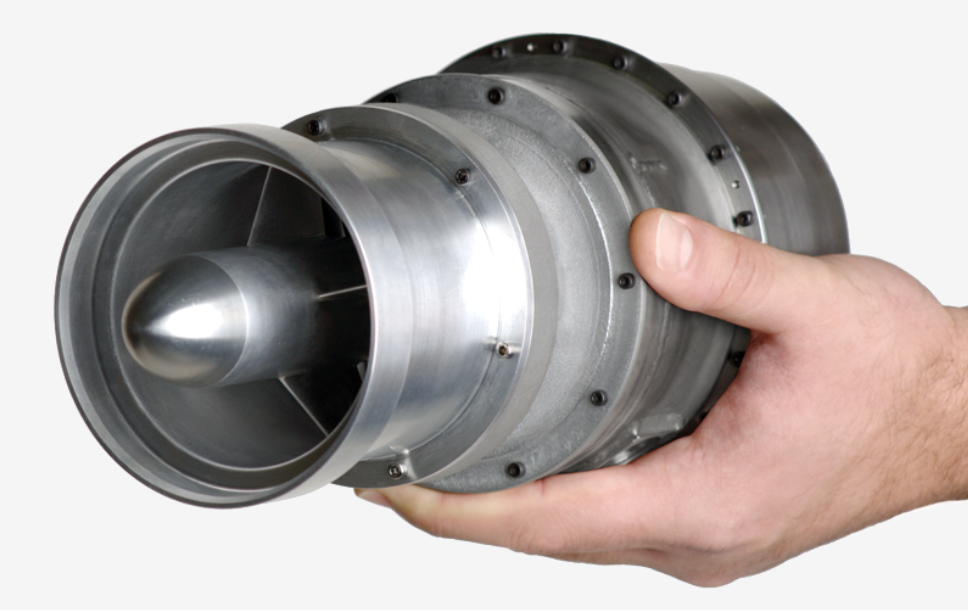

Microturbine systems, also known as combustion turbines or gas turbines, are compact combustion-based systems which generate continuous power in the range of 25-500 kW. They provide distributed generation of heat and power for commercial and industrial applications with benefits such as high reliability, fuel flexibility, reduced emissions and quiet operation. Due to their small size, microturbine systems are ideal for installation at sites with space constraints and power needs ranging from 25kW to 1MW. The global microturbine systems market is driven by factors such as growing demand for clean and reliable power generation coupled with mandates to reduce greenhouse gas emissions.

The Global Microturbine Systems Market is estimated to be valued at US$ 91.32 Billion in 2024 and is expected to exhibit a CAGR of 34% over the forecast period from 2024 to 2031.

Key Takeaways

Key players operating in the Microturbine Systems Market are Bavarian Nordic, Argos Therapeutics, Antigenics, Affiris, Celldex Therapeutics, Biovest International, Cel-Sci, Celtic Pharma, Cytos Biotechnology, and Curevac.

The growing demand for clean and reliable power along with strict regulatory emission norms are fueling the adoption of microturbine systems across industrial and commercial segments. The ability of Microturbine Systems Market to use multiple fuels along with low operational and maintenance costs make them an attractive alternative to diesel gensets and lean combustion gas engines.

Major microturbine manufacturers are focusing on geographic expansion through strategic collaborations and partnerships with local system integrators to leverage emerging opportunities across different regions. For example, Capstone Turbine expanded its global footprint through a distribution agreement with Kohler Unicontrol for the Southeast Asia market.

Market key trends

There is an increased focus on the development of modular and containerized microturbine systems for rapidly deployable off-grid and backup power applications. These plug-and-play systems allow for ease of installation and maintenance. Companies are innovating compact design configurations to increase the power-to-space ratio and facilitate deployment in space-constrained urban areas.

Porter’s Analysis

Threat of new entrants: Microturbine technology requires significant investment which prevents new companies from entering the market easily.

Bargaining power of buyers: Buyers have moderate bargaining power as there are multiple established players in the market offering varying capacity microturbines.

Bargaining power of suppliers: Component suppliers have low bargaining power due to availability of substitutes and lack of dependency on a single technology.

Threat of new substitutes: Threat from other small-scale power generation technologies like fuel cells and solar PV panels is moderate as microturbines offer advantages of high efficiency and easy installation.

Competitive rivalry: The market sees high competition due to presence of global and regional players offering technology upgrades and customized solutions.

North America dominates the global microturbine systems market currently, accounting for over 35% of the total market value. Microturbines are commonly used as back-up power sources in commercial buildings, IT centers and telecom towers across USA and Canada. China has emerged as the fastest growing regional market for microturbine systems over the last few years. Rising adoption of microturbine CHP systems in China’s industrial sector is one of the key factors driving market growth. Increasing investments by Chinese manufacturers to diversify product offerings will further accelerate market expansion during the forecast period.

Note:

1. Source: Coherent Market Insights, Public sources, Desk research.

2. We have leveraged AI tools to mine information and compile it.