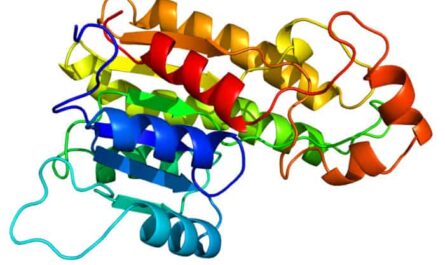

The US biochip product and services market provides an array of biochips to perform assays efficiently. Biochips analyze the specific targets by providing required conditions for biochemical reactions. They are fabricated with nanoscale structures that detect and analyze biomolecules including DNA, proteins, and enzymes. Biochips offer benefits such as high throughput and parallel processing, sensitivity, and reduced time consumption. The growing research activities in genomics and proteomics have increased the demand for biochips.

The US Biochip Product and Services Market is estimated to be valued at US$ 8.76 Mn in 2024 and is expected to exhibit a CAGR of 6.3% over the forecast period 2024 to 2031.

Key Takeaways

Key players operating in the US Biochip Product And Services Market Size are Galderma SA, Allergan plc (AbbVie Inc.), Bayer AG, Pfizer Inc., Leo Pharma A/S, Sol-Gel Technologies Ltd., Foamix Pharmaceuticals Ltd., Mayne Pharma, Group Limited, AnaptysBio, Inc., Mylan N.V.

The rising R&D spending on drug discovery and genomic applications has increased the demand for biochips. Biochip manufacturers are focusing on developing novel biochips with advanced features to analyze biomolecules efficiently.

The growing investments by pharmaceutical companies and research organizations have accelerated clinical research activities. This has prompted many biochip companies to expand their operations globally and establish manufacturing and distribution networks across major markets.

Market key trends

The advancement in microfabrication and nanotechnology has enabled the development of microarrays and protein chips with enhanced sensitivity and accuracy. Miniaturized biochips can analyze complex body fluids efficiently. Researchers are also developing three-dimensional biochips to provide a native-like biochemical environment for analysis. Such technological innovations are expected to boost the adoption of biochips significantly over the forecast period.

Porter’s Analysis

Threat of new entrants: The US biochip industry requires high capital investments and stringent regulatory requirements which limit the threat of new entrants.

Bargaining power of buyers: Large customers like pharmaceutical and biotechnology companies have significant bargaining power over biochip providers due to their scale and buying power.

Bargaining power of suppliers: Due to limited suppliers for raw materials and components, the biochip manufacturers are dependent on a few suppliers resulting in relatively high bargaining power of suppliers.

Threat of new substitutes: Alternative medical diagnostic solutions pose low threat of substitution to the biochip industry currently but this threat may increase going forward as new technologies emerge.

Competitive rivalry: The biochip industry in US is dominated by a few large players creating intense competition over market share and pricing.

The US market currently accounts for over 40% share of the global biochip industry in terms of value due to strong investments in research and healthcare sector. States like California, Massachusetts, Pennsylvania and New York have emerged as major centers for biochip companies owing to presence of leading research universities and industry clusters.

Asia Pacific region is expected to be the fastest growing market for biochips during the forecast period supported by increasing healthcare expenditures, expanding life sciences industry and growing geriatric population in countries like China and Japan. China particularly is attracting significant FDI in pharmaceutical and medical devices sector propelling demand for advanced biochip technologies in the region.

Geographical Regions

The Western region of the United States, including states like California, Washington and Colorado accounts for the largest share of the biochip market currently due to strong research funding and presence of major biochip companies. The Northeastern region comprising states such as Massachusetts, New York and Pennsylvania is another key market driven by extensive R&D infrastructure and industry clusters located in cities like Boston, New York and Philadelphia. The Southern states of Texas, North Carolina and Florida are emerging biochip hubs on back of large life sciences industry base and growing biomedical research activities.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it