Singapore Launches Carbon Credit to Boost Climate Action

Carbon emissions are rising rapidly across the world threatening our environment and future generations. To tackle the climate crisis, countries are developing innovative policy tools and market-based mechanisms. Singapore has recently joined this global effort by launching its domestic carbon credit market – the Singapore Carbon Pricing Initiative. This new initiative aims to curb emissions cost-effectively while supporting businesses in their transition to low-carbon operations.

The Need for a Carbon in Singapore

As a small and densely populated city-state, Singapore Carbone Credit is highly vulnerable to the impacts of climate change like rising sea levels, extreme heat, and changing rainfall patterns. However, being a trade-reliant economy, constraints on carbon also pose economic challenges. To balance its climate and economic priorities, Singapore has set an ambitious target of halving its emissions from its peak by 2050 with an aim to achieve net-zero emissions as soon as viable in the second half of the century.

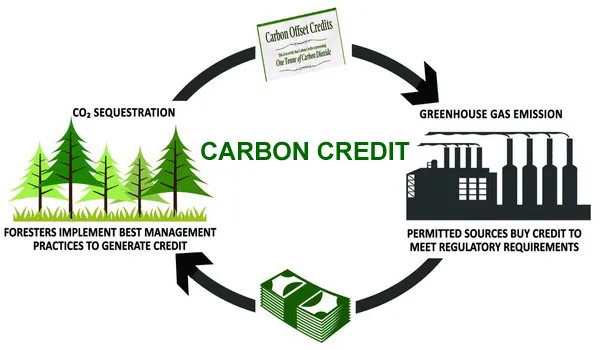

Reaching these long-term goals would require significant emission reductions across different sectors of the economy. But directing public funds alone would not be enough and incentivizing private investment in low-carbon solutions is equally important. This is where carbon pricing through a cap-and-trade system can help by creating a financial value for every ton of CO2 saved or sequestered. It provides market incentives for emissions reduction while supporting innovation and economic growth.

Launch of Singapore Carbon Pricing Initiative

In 2019, Singapore launched a domestic emissions trading scheme called the Singapore Carbon Pricing Initiative administered by the National Environment Agency (NEA). Under this initiative, facilities emitting over 25,000 tons of CO2 per year have to surrender one carbon credit for every ton of emissions. Eligible sectors include power generation, petrochemicals, semiconductor manufacturing, and other industrial processes.

The initiative started with a pilot phase in 2019-2021 to test its design and functionality. During this period, annual carbon credits were set at S$5 per ton of CO2. Post the successful pilot run, the market officially commenced operations from January 2022. In its first compliance year, the credit price has been set at S$25/ton which is expected to gradually increase in future years to provide stronger incentives for decarbonization.

Design Features of Singapore’s Carbon

Singapore’s carbon pricing initiative incorporates some unique design elements compared to other existing carbon markets globally:

– Hybrid Design: It combines elements of cap-and-trade and carbon tax. Regulated entities must surrender allowances for their emissions but face a compliance obligation instead of a hard emissions cap.

– Output-based Allocation: Free carbon credits are allocated based on a facility’s production output and carbon intensity benchmarks. This helps address competitiveness concerns for trade-exposed sectors.

– Trade Platform: An electronic trading platform called the Singapore Climate Action Exchange (SCAX) facilitates credit trading between regulated and voluntary entities.

– Use of Offset Credits: Regulated entities can meet up to 5% of their compliance obligation using approved offset credits from overseas projects that reduce emissions.

– Linkage with International Markets: The initiative aims to eventually link with other carbon markets in the region like China and potentially Korea to expand the trading scope.

Early Impact and Future Prospects

Since its launch, Singapore’s carbon has seen encouraging participation from both the regulated and voluntary sectors. During the pilot period itself, over S$300 million worth of carbon credits changed hands on the SCAX platform. Major companies are now factoring an internal carbon price in their investment decisions, driving efforts to adopt cleaner technologies and switching to renewable energy.

As credit prices rise further in the coming years per Singapore’s plans, the carbon market is expected to play a larger role in boosting the nation’s climate action. Its unique design allows balancing economic and industrial priorities while incentivizing decarbonization. While the impact will take time to materialize fully, the initiative provides a pathway for Singapore to achieve its long-term net-zero goal in a cost-effective manner. It also holds important lessons for other countries looking to develop robust carbon pricing policies. If successful, Singapore’s experiment could catalyze low-carbon growth pathways across the region.

*Note:

1.Source: CoherentMI, Public sources, Desk research

2.We have leveraged AI tools to mine information and compile it