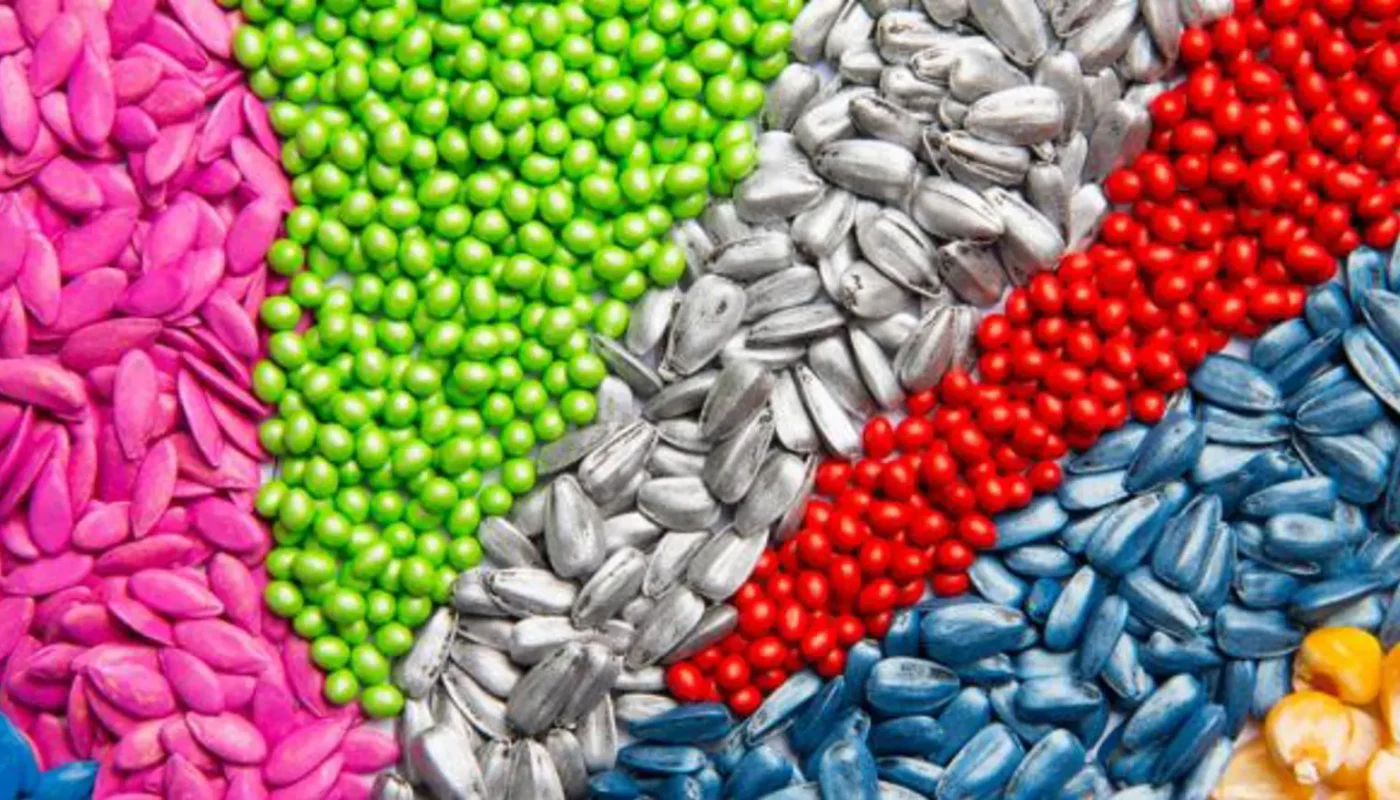

Seed treatment has emerged as one of the major drivers of crop protection and yield optimization over the past decade. Seed treatment products protect the seeds and young plants from common diseases, insects, and other stresses until they can establish themselves in the field. This pre-planting protection enhances seedling establishment and vigor for better stand establishment. Seed treatments contain a combination of fungicides, insecticides and other active ingredients that shield seeds from soilborne and seedborne pathogens. The global seed treatment market encompasses a wide range of products including biologicals, chemical treatment and other integrated solutions. With a wide range of benefits like improved plant health, higher yields and reduced waste, seed treatment products are becoming increasingly popular among farmers worldwide. The Global Seed Treatment Market Size is estimated to be valued at US$ 7.87 Bn in 2024 and is expected to exhibit a CAGR of 19% over the forecast period 2024 to 2031, as highlighted in a new report published by Coherent Market Insights.

Market key trends:

One of the major trends gaining traction in the seed treatment industry is the growing preference for biological seed treatment options. Concerns around excessive chemical usage and rise of resistance have prompted increased R&D towards biological seed treatments. Biological seed treatments utilize various microorganisms to promote plant health. Effective microbes present in biological seed treatments protect seeds and surrounding soil from diseases while improving nutrient uptake. Leading players are focused on developing innovative biofungicide and bionematicide formulations to organically boost crop immunity and yield. As sustainable agricultural practices gain prominence, demand for biological seed treatment solutions is expected to increase significantly over the coming years.

Porter’s Analysis

Threat of new entrants: The threat of new entrants in the seed treatment market is moderate as this industry requires high initial investments and developing technological capability.

Bargaining power of buyers: The bargaining power of buyers is moderate in the seed treatment market as buyers have multiple options available in the market.

Bargaining power of suppliers: The bargaining power of suppliers is low in the seed treatment market owing to presence of large number of suppliers providing similar kind of products and services.

Threat of new substitutes: Potential substitutes to seed treatment include developing seeds that can resist diseases and improve yield without requiring treatment. However, seed treatment still remains indispensable to maximize crop yields.

Competitive rivalry: The competition is high among the existing players in the seed treatment market as they continuously invest in research & development to develop innovative products and technology.

Key Takeaways

The global seed treatment market is expected to witness high growth. The market size is projected to reach US$ 7.87 Bn by 2024 from US$ 4.24 Bn in 2019, expanding at a CAGR of 19% during the forecast period.

Regional analysis: North America dominates the global seed treatment market owing to growing demand for enhanced yield and crop protection in major countries like the US and Canada. The Asia Pacific region is expected to be the fastest growing market for seed treatment driven by increasing population and rising awareness about benefits of seed treatment in major countries like India and China.

Key players operating in the seed treatment market are Trimble Inc., 3D Systems Inc., ShapeGrabber Inc., Creaform, Hexagon AB, GOM, 3D Digital Corp, Faro Technologies Inc., Autodesk, Inc., Topcon Corporation. They are focusing on development of new technologies and products to strengthen their market position.

*Note:

1.Source: Coherent Market Insights, Public sources, Desk research

2.We have leveraged AI tools to mine information and compile it