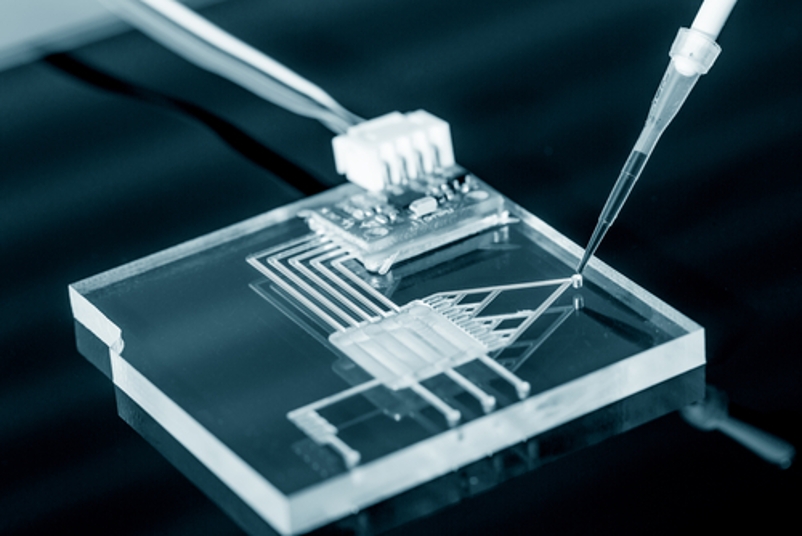

Microfluidics is the science and technology of systems that process or manipulate small amounts of fluids using channels with dimensions of tens to hundreds of micrometers. Microfluidic devices are applied in various fields including medical devices, diagnostics, and pharmaceutical applications. In medical applications, microfluidics chips are used in point-of-care testing for diagnosis of diseases like cancer, diabetes, and infectious diseases. These chips offer reliable analysis on small sample volumes with high accuracy and sensitivity. The devices are also used for drug discovery and development processes such as in microarrays that monitor cell-drug interactions.

The global microfluidic market is estimated to be valued at US$ 22.3 billion in 2023 and is expected to exhibit a CAGR of 4.0% over the forecast period 2023 to 2031, as highlighted in a new report published by Coherent Market Insights.

Market Dynamics:

The growing adoption of microfluidic devices in medical applications is a major driver propelling the growth of the market. Microfluidic chips are increasingly replacing conventional diagnostic techniques due to advantages such as smaller sample size requirement, reduced reagent consumption, multi-assays on a single chip, and portability. Additionally, the demand for point-of-care testing devices is growing owing to the increasing prevalence of chronic and infectious diseases worldwide. Point-of-care devices enable real-time diagnosis and monitoring of health parameters using microfluidic on-chip techniques directly at the location of patients. This factor is also boosting the demand for microfluidic technology in the healthcare industry.

Segment Analysis

The global microfluidic market is dominated by the point of care and in vitro diagnostics segment. This segment accounted for more than 35% of the overall market share in 2023, driven by the growing demand for POC testing kits for pregnancy, glucose, infectious diseases etc. that can be used outside the laboratory setups. Within this segment, the diagnostics sub-segment leads owing to increasing adoption of microfluidic based lab-on-a-chip technologies for conducting various medical tests with minimum sample volumes.

Pest Analysis

Political: Regulations regarding medical device approval and point-of-care testing are supporting market growth. Various government initiatives are promoting adoption of microfluidics technology.

Economic: Rising healthcare costs are boosting demand for low-cost and rapid diagnostics offered by microfluidic systems. Growing biotech and pharmaceutical industries also have a positive influence on market expansion.

Social: Increasing awareness about advantages of microfluidics such as lower reagent consumption, rapid results and portability is favoring market growth. High disease prevalence is another factor driving demand.

Technological: Continuous innovation in the areas of materials, design, and fabrication methods are extending application scope. Development of 3D printing techniques for manufacturing microfluidic devices is further strengthening market prospects.

Key Takeaways

The Global Microfluidic Market Growth is expected to witness high during the forecast period, driven by rising demand for POC and in vitro diagnostic testing. The global microfluidic market is estimated to be valued at US$ 22.3 billion in 2023 and is expected to exhibit a CAGR of 4.0% over the forecast period 2023 to 2031.

North America dominates the market currently owing to favorable regulatory environment and presence of major players in the region. The region is expected to remain the highest revenue generator during the forecast period as well.

Key players operating in the microfluidic market are Nike, Adidas AG, Borosil, Milton, H2O International SA., shanghai Atlantis Industry Co. Ltd, SIGG Switzerland Bottles AG, Decathlon S.A., Puma SE, and Camlin Kokuyo. Key players are mainly focusing on new product launches and expansion strategies to strengthen their market presence. For instance, in 2023 Milton launched its new Microdrop bottle that can deliver ultra-precise microliter volumes for various microfluidic applications.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it