The India Flexfuel Cars Market is estimated to be valued at US$611.8 million in 2023 and is expected to exhibit a CAGR of 15% over the forecast period 2023-2030, as highlighted in a new report published by Coherent Market Insights.

Market Overview:

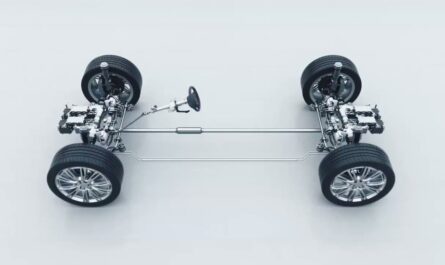

Flexfuel vehicles are capable of operating on more than one type of fuel like gasoline or ethanol without any engine modifications. In India, these vehicles run on a blend of gasoline and ethanol. Ethanol used is produced locally from sugarcane molasses. Flexfuel vehicles help reduce dependence on crude oil imports and provide an alternative fuel source. They also help reduce carbon emissions.

Market Dynamics:

The India flexfuel cars market is expected to witness significant growth owing to the increasing focus of both government and private players to promote alternative fuels for transportation. The Indian government has initiated production of ethanol from sugarcane and other agricultural residues, allowing higher blending of ethanol with gasoline. It aims to achieve 20% ethanol blending with gasoline by 2025. This is boosting demand for flex-fuel vehicles that can run on this blended fuel. additionally, growing environmental concern and rising fuel prices are prompting consumers to shift to more eco-friendly mobility solutions like flex-fuel vehicles. Government incentives and subsidies on purchase of such vehicles are further fueling their adoption in the country.

SWOT Analysis

Strength:

– India has set a target to reduce its carbon footprint and pushing for more sustainable fuels. Introduction of FFV cars supports this initiative.

-Growing awareness about environmental protection and willingness to adopt green technologies among Indian consumers.

-Policy support from government in the form of tax benefits for customers as well as manufacturers.

Weakness:

-Limited fuel infrastructure for alternative fuels like ethanol in India.

-Higher initial costs of FFV cars compared to regular petrol/diesel cars.

Opportunity:

-Rising petrol and diesel prices making alternative fuels economically viable.

-Potential to develop India as a manufacturing hub for flex-fuel cars with growing domestic demand.

Threats:

-Dominance of conventional petrol and diesel cars in context of existing fuel infrastructure.

-Uncertainty over consistent supply and pricing of alternative fuels.

Key Takeaways

India Flexfuel Cars Market Size is expected to witness high growth, exhibiting CAGR of 15% over the forecast period, due to increasing policy support from government for adoption of sustainable mobility solutions. Regional analysis

The India region currently dominates the India Flexfuel Cars market with more than 45% share, led by early introduction of flex fuel variants and availability of key alternative fuels like ethanol. States like Maharashtra, Karnataka and Uttar Pradesh are emerging as key markets.

Key players

Key players operating in the India Flexfuel Cars market are Maruti Suzuki, Hyundai, Tata Motors, Nissan, Renault, Mahindra & Mahindra, Toyota, Honda, Ford, Volkswagen. Major automakers have launched flexible fuel variants of their popular models to tap the growth potential.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it