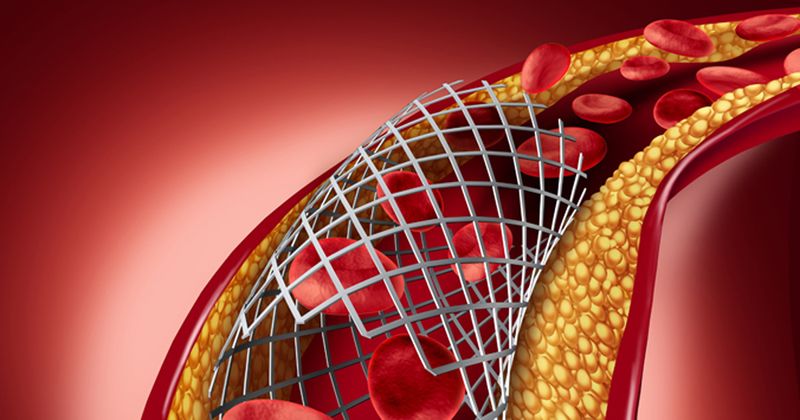

The India coronary stents market offers minimally invasive surgical procedures used to open narrowed or blocked coronary arteries that supply oxygen-rich blood to the heart. The demand for coronary stents in India is growing due to the increasing prevalence of cardiovascular diseases, rising healthcare expenditure, and launch of advanced stent technologies. The bioabsorbable stents are gaining more attraction due to their ability to get dissolved in the body overtime after implantation. The traditional metal stents stay in the artery permanently whereas bioresorbable stents degrade and absorb into the body completely over a period.

The Global India Coronary Stents Market is estimated to be valued at US$ 1501.64 Bn in 2024 and is expected to exhibit a CAGR of 9.6% over the forecast period 2024 to 2031.

Key Takeaways

Key players operating in the India coronary stents market are Allflex, Datamars, Zee Tags, Leader Products, Fitbit, SCR Dairy. Allflex and Datamars together hold over 50% market share in the India coronary stents market.

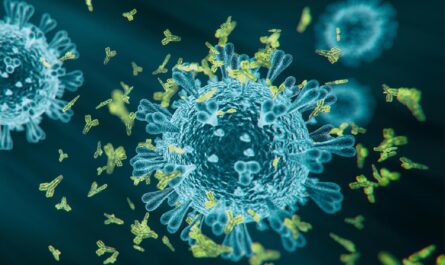

The growing incidences of cardiovascular diseases and increasing healthcare expenditure are fueling the demand for coronary stents in India. As per WHO estimates, cardiovascular diseases accounted for 33% of total deaths in India in 2019. The total healthcare spending in India is projected to reach US$ 372 billion by 2022 from US$ 60 billion in 2014.

Major stent manufacturers are expanding their global footprint through mergers and acquisitions. For instance, in 2019, Leader Products acquired Datamars to expand its presence in India and Middle East coronary stents market. Allflex acquired Fitbit to strengthen its product portfolio and distribution network across Asia.

Market key trends

Miniaturization of coronary stents is a key trend in the India market. Technological advancements are enabling manufacturers to develop mini and micro stents that can access smaller vessels and branches more effectively. This is increasing the application of stents in treating complex blockages. Customized stents based on patient-specific anatomy is another emerging trend gaining prominence.

Porter’s Analysis

Threat of new entrants: The threat of new entrants in the India coronary stents market size is moderate due to the requirement of huge capital investment and established brand image of existing players.

Bargaining power of buyers: The bargaining power of buyers in the India coronary stents market is high due to the presence of a large number of players providing coronary stents at competitive prices.

Bargaining power of suppliers: The bargaining power of suppliers in the India coronary stents market is moderate due to the availability of raw material suppliers.

Threat of new substitutes: The threat of new substitutes in the India coronary stents market is low as there are limited treatment substitutes for coronary stents.

Competitive rivalry: The competitive rivalry in the India coronary stents market is high.

Geographical Regions

India represents the largest market for coronary stents in terms of value in the Asia Pacific region. North India accounts for over 50% of the total India coronary stents market value due to higher incidences of cardiovascular diseases and supportive healthcare infrastructure in states like Delhi, Uttar Pradesh, and Haryana.

South India is the fastest growing region for the India coronary stents market during the forecast period. States like Karnataka, Tamil Nadu, and Kerala are expected to witness high demand for coronary stents attributed to increasing healthcare awareness, rising medical tourism, and improving access to healthcare facilities.

*Note:

- Source: Coherent Market Insights, Public sources, Desk research

- We have leveraged AI tools to mine information and compile it