The Hardware Wallet Market is estimated to be valued at US$ 354.28 Mn in 2023 and is expected to exhibit a CAGR of 24% over the forecast period 2023 to 2030, as highlighted in a new report published by Coherent Market Insights.

Market Overview:

A hardware wallet is a physical container that stores public and private keys of digital currencies such as bitcoin. It allows users to control and access their private keys through a hardware storage device instead of storing the keys on a computer. Hardware wallets have advanced security features such as PIN codes, passwords, touchscreens and others which makes private keys inaccessible to hackers even if the device is infected with malware. They ensure secure storage and signing of digital currency transactions. Rising cryptocurrency market and awareness about security of digital assets among users is fueling adoption of hardware wallets.

Market Dynamics:

Growing adoption of cryptocurrency is a major driver augmenting growth of the hardware wallet market. As investments in cryptocurrencies are growing rapidly, security of digital assets has become a key concern for users. Hardware wallets provide robust security and safety against theft, hacking and loss of private keys. This is encouraging users to adopt hardware wallets for storing cryptocurrencies. Moreover, increasing institutional investments and rising launch of new altcoins are also propelling demand for secure storage solutions like hardware wallets. However, availability of free software wallets limiting utility of hardware wallets only for high value transactions is a challenge for widespread adoption of these devices.

Segment Analysis

The hardware wallet market is dominated by desktop or laptop hardware wallets sub segment due to their large storage capacity and security features. Desktop or laptop hardware wallets have more storage space to hold multiple cryptocurrencies and support a variety of cryptocurrencies and blockchain networks. Their large screen size makes them easier to use for complex transactions.

PEST Analysis

Political: Regulations around cryptocurrency exchanges and investments have increased in recent times, driving interests in secure hardware wallets for storing crypto assets.

Economic: Cryptocurrency market volatility and increasing valuation of digital currencies have encouraged long term individual investors to use hardware wallets for secure storage of crypto holdings.

Social: Growing social media discussions around cryptocurrencies and blockchain have boosted awareness about hardware wallets for securing crypto investments.

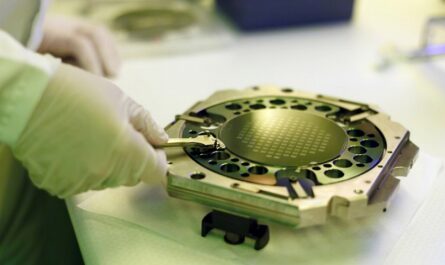

Technological: Advances in hardware wallet chip security, biometric authentication and support for multiple crypto assets on a single device have spurred their adoption.

Key Takeaways

The Global Hardware Wallet Market Size is expected to witness high growth, exhibiting CAGR of 24% over the forecast period, due to increasing investments in cryptocurrencies. In 2023, the market size for hardware wallets is estimated to reach US$ 354.28 Mn.

Regional analysis shows that Asia Pacific will be the fastest growing market for hardware wallets owing to a surge in cryptocurrency investments from countries like China, India and South Korea. North America currently dominates the hardware wallet market led by the United States.

Key players operating in the hardware wallet market are ARCHOS S.A., ELLIPAL LTD., LEDGER SAS and OPOLO SARL. Ledger SAS hold a major market share due to its wide variety of wallet models, cross compatibility and reputation of high security standards. Ellipal also has a growing customer base attracted by its simple to use touch screen models.

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it