The global ethylene market has been growing steadily owing to the increasing demand for polymers such as polyethylene. Ethylene finds wide applications as a building block for various plastics and resins used across industries like packaging, construction and automotive. It is used to produce polyethylene which is further used to manufacture plastic films, containers, bottles and various other everyday use plastic products due to its properties such as durability, flexibility and chemical resistance. The rising demand for plastic products has been a key driver for the growth of the global ethylene market.

The Global Ethylene Market is estimated to be valued at US$ 158.06 Mn in 2024 and is expected to exhibit a CAGR of 30% over the forecast period 2024 to 2031.

Key Takeaways

Key players operating in the global ethylene market are Aecom, DPR Construction, Holder Construction, Jacobs, M+W Group (Exyte), Bouygues Construction, Mercury, Arup, and Benthem Crouwel Architects. Ethylene is a crucial petrochemical that serves as a building block for various plastics like polyethylene, ethylene glycol, ethylene oxide, and polyvinyl chloride (PVC). The demand for plastic products is growing significantly with expansion of end-use industries, thus boosting the consumption of ethylene.

The global polyethylene market volume crossed 110 million metric tons in 2020 and is expected to grow further at over 5% CAGR until 2030, thereby augmenting the demand for ethylene as the basic raw material for the production of polyethylene. Various countries across Asia Pacific, Europe, North America and Middle East are expanding their production facilities of petrochemicals to leverage growing local consumption of plastics.

Mass adoption of plastic in packaging industry driven by e-commerce boom has been a key factor supplementing market growth. Further, recovery of construction sector post pandemic has increased consumption of PVC used widely in pipes, fittings, doors and windows. This would aid the expansion of ethylene market over the forecast timeline.

Market key trends

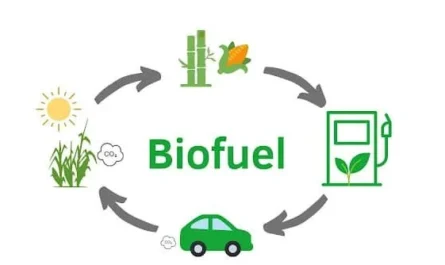

One of the major trends gaining traction in the Global Ethylene Market Size is increasing production from non-naphtha feedstock. While naphtha remains the primary feedstock, ethane cracked from shale gas is emerging as an economically viable option. The availability of inexpensive ethane from the U.S. has boosted investments toward setting up new petrochemical plants based on ethane feedstock. Further advances in steam cracking process with hybrid furnace technologies would aid improving yields and lowering costs for ethylene manufacturers.

Porter’s Analysis

Threat of new entrants: High capital requirements for setting up an ethylene plant limit the number of new entrants in the global ethylene market.

Bargaining power of buyers: Large buyers such as plastic manufacturers have moderate bargaining power due to availability of substitutes and presence of many established ethylene producers.

Bargaining power of suppliers: Major suppliers of raw materials such as naphtha and natural gas have lower bargaining power due to availability of alternatives and substitutes.

Threat of new substitutes: Alternatives such as propylene have limited substitution threat owing to ethylene’s unique properties and versatile uses in plastics industry.

Competitive rivalry: The Global Ethylene Market features strong competition among major producers on the basis of production capacity, product quality, and pricing.

Geographical regions: North America currently accounts for the largest share of the global ethylene market, in terms of value, owing to high demand from plastics and packaging industries in the region.

The Asia Pacific region is expected to be the fastest growing market for ethylene during the forecast period, mainly due to rising disposable incomes, growing population, and rapid industrialization in major economies such as China and India.