The electrical insulation coatings market is witnessing trends of materials sustainability by reducing VOCs emissions. Electrical insulation coatings provide protective layers on metals, alloys, laminates and composites which are exposed to high operating voltages. They are used in diverse applications ranging from rotating machines, transformers, cables, switchgears and more. Their key function is to insulate electrical conductors from short circuits and ground faults which could damage equipment or pose safety risks.

The Global Electrical Insulation Coatings Market is estimated to be valued at US$ 2.67 BN in 2024 and is expected to exhibit a CAGR of 4.7% over the forecast period 2024 to 2031.

Growing investments in renewable energy, rising demand for insulating electric vehicles and infrastructure expansion are fueling the demand for these protective coatings.

Key Takeaways

Key players operating in the Electrical Insulation Coatings Market Size are ELANTAS PDG, Inc., GLS Coatings Ltd., SK FORMULATIONS INDIA PVT. LTD., PTFE Applied Coatings, Axalta Coating Systems, LLC, Akzo Nobel N.V., Evonik Industries AG, 3M, PPG Industries, Inc., Thermal Spray Coatings (A Fisher Barton Company), GfE Gesellschaft für Elektrometallurgie mbH.

The global electrical insulation coatings market is projected to grow at a rapid pace owing to increasing demand from the power industry. Various government initiatives pertaining to sustainable energy are expected to drive the market growth during the forecast period.

North America held the largest market share in 2021 owing to high investments in T&D infrastructure and renewable energy industry. However, Asia Pacific is expected to witness highest growth rate due to expanding electronics industry and power grid investments in China and India.

Market key trends

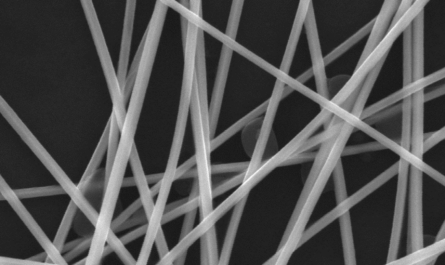

One of the key trends witnessed in the electrical insulation coatings market is the increasing use of bio-based and eco-friendly materials. Stringent regulations regarding VOC emissions have compelled manufacturers to invest in sustainable solutions. Some bio-based polymers developed as coatings include polylactic acid (PLA), polyhydroxyalkanoates (PHA) and soy-based polyols. Their renewable content provides compliance along with cost competitiveness. Additionally, development of water-based formulation is another trend as they eliminate usage of flammable solvents in production. This transitions the industry towards environmentally friendly practices.

Porter’s Analysis

Threat of new entrants: High capital requirements and economies of scale in production and distribution pose significant barriers to entry in this industry.

Bargaining power of buyers: Buyers have moderate bargaining power due to the availability of substitute products and pricing competition among existing players.

Bargaining power of suppliers: A few large players dominate the supply of raw materials, giving them moderate bargaining power over coatings manufacturers.

Threat of new substitutes: Traditional insulation materials continue to compete with advanced coatings, though substitutions may increase with technological developments.

Competitive rivalry: Competition is fierce with market leaders continually investing in R&D and expanding production capacities globally to defend market shares.

Geographical concentration: North America currently accounts for the largest share of the electrical insulation coatings market, valued at US$1.05 billion in 2024 due to high demand from utilities and OEM industries.

Fastest growing region: Asia Pacific region is poised to grow at the fastest CAGR of 5.7% during the forecast period, driven by increasing investments in transmission & distribution infrastructure and steady replacement demand in China, India, Japan and other developing Asian countries

*Note:

1. Source: Coherent Market Insights, Public sources, Desk research

2. We have leveraged AI tools to mine information and compile it